Cogitate

Resources

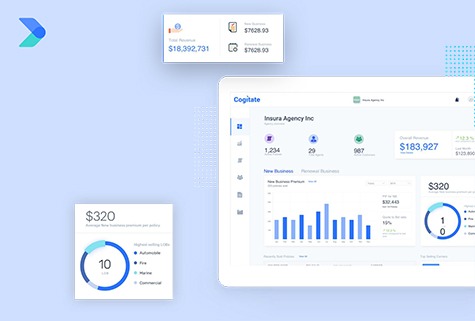

DigitalEdge Distribution Management

Simplify the management of your agent and agency relationships. Easily access and navigate agency information for real-time response, service requests, and status changes.

DOWNLOAD BROCHURE

Professional Liability MGA Leverages Data and Automation

This client success brief exemplifies speed of implementation to scale your business on our digital insurance platform.

DOWNLOAD CASE STUDY

Cogitate & Vertafore – the Ultimate Orange Partnership

Check out this brief for 10 key benefits these integrations are bringing our mutual clients with no disruption to centralized operations relying on AIM and ImageRight.

DOWNLOAD BROCHURE

National MGA Speeds Cycle Times and More.

Learn how this National MGA transformed its submission and underwriting of multiple personal property coverages with Cogitate.

DOWNLOAD CASE STUDY

Key Tech Insights from Industry Leaders

This eBook is adapted from our most watched webinar of 2023, featuring clients sharing benefits of their digital transformation projects. Get right to the point with summaries of key points and projects!

DOWNLOAD WHITEPAPER

Claims Intelligence, Predictive Modeling, & Data Validation

Learn how data validation tools, claims intelligence and predictive modeling support your teams across the policyholder and claims lifecycles to make faster, smarter decisions for a more profitable future.

DOWNLOAD WHITEPAPER

Integration of Vertafore AIM with Cogitate DigitalEdge

View this action packed 3-minute video of Cogitate DigitalEdge Policy's seamless integration with Vertafore AIM.

WATCH VIDEO

Cogitate’s Jacqueline Schaendorf on the Opportunities in the E&S Industry

Cogitate's Co-Founder, Jacqueline Schaendorf, President and CEO of Insurance House, is a long time, very active member of WSIA. In this new video presented by WSIA, Jacqueline shares her experience in the E&S market to support career awareness about the industry.

WATCH VIDEO

Ready, Set, Innovate! Industry Leaders Target Data, AI, and Distribution

Watch now on demand. Industry leaders discuss business drivers, expectations and outcomes of their tech initiatives to improve user experience, risk selection, uses of data and AI, and much more.

WATCH VIDEO

DigitalEdge Claims

Cogitate DigitalEdge Claims is designed to provide your adjusters and claims professionals with the tools and digital experience to engage and respond with speed, accuracy, and the personalized service each policyholder and claimant deserves.

DOWNLOAD BROCHURE

DigitalEdge Policy

Cogitate DigitalEdge Policy is designed to offer your policyholders, distribution partners, and internal teams the tools and unified digital experience that ensures you retain your clients, grow your book, maximize your talent’s capacity and capabilities, and enhance risk selection. Read our product brief for an overview of DigitalEdge Policy capabilities.

DOWNLOAD BROCHURE

DigitalEdge Billing

Cogitate DigitalEdge Billing is designed to provide your customer service professionals with the tools and digital experience to service your policyholders with the utmost confidence and flexibility. Read our product brief for an overview of DigitalEdge Billing capabilities

DOWNLOAD BROCHURE

Traders Modernizes Claims System for Superior Experience

Traders sought the replacement of its home-grown claims system with a modern platform for improved claimant experience, increased internal efficiencies, and access to integrations with third-party solutions. Traders Insurance views the claims experience as an opportunity to deliver on its promise to the policyholder and chose Cogitate to make that experience exceptional for all stakeholders.

DOWNLOAD CASE STUDY

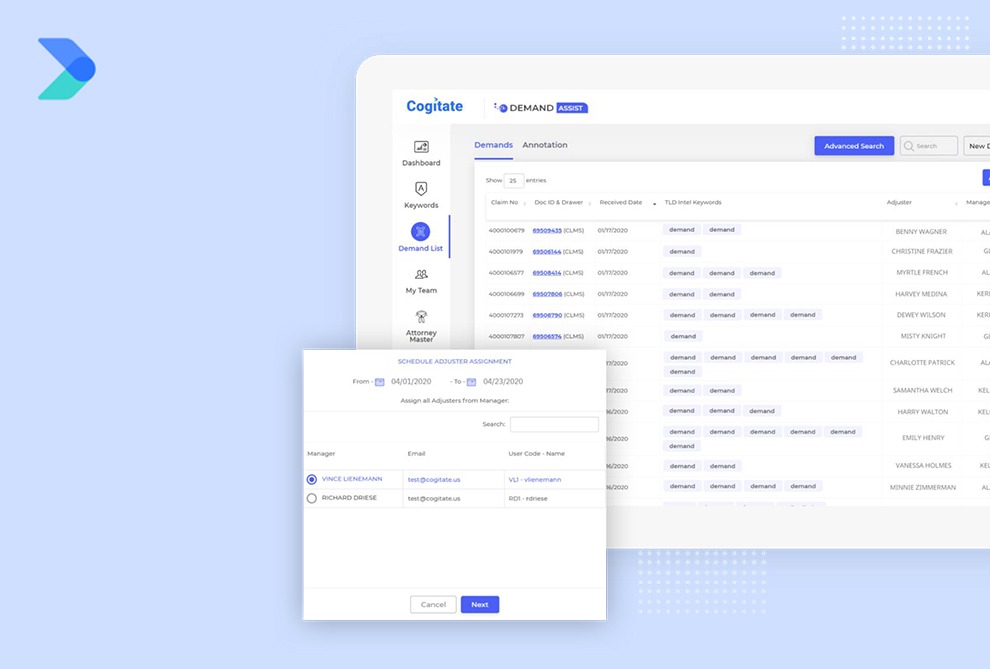

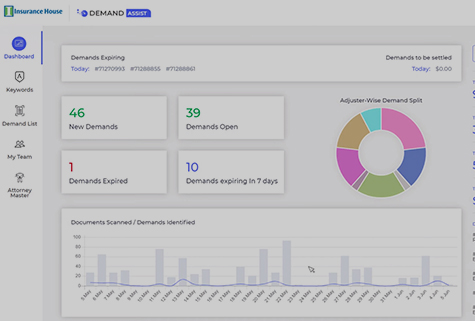

SGIC Finds Savings and Peace of Mind with DemandAssist

Southern General Insurance Company (SGIC) faced costly challenges with reliance on manual processes to identify and manage Time Limit Demand Letters. With the integration of Cogitate’s DemandAssist, OCR and text mining now scan over 150 letters in less than 30 minutes every day. Automated notifications and management of the process have resulted in zero slippage, giving peace of mind to SGIC’s claims team.

DOWNLOAD CASE STUDY

Ecosystem Partner Profile: Confianza on Intelligence and Underwriting Auto Lines

Integrated with Cogitate’s DigitalEdge Platform, Confianza helps insurers accelerate digital transformation. One of their trending use cases is the identification and prevention of premium leakage and fraud. Here are more details from John Petricelli, Chief Data Officer of our ecosystem partner Confianza.

Read More

Ecosystem Partner POV: e2Value on Property Intelligence and Underwriting

Skip Coan, SVP of e2Value joined Cogitate to discuss the recent economic trends impacting homeowners and commercial property insurance. Skip addressed the undervaluation of properties due to escalating replacement costs and how e2Value is working hard to educate the industry on rectifying this problem.

Read More

3+ Keys to Proactive Underwriting

Read this eBook to learn the key elements of the intelligent underwriting workbench critical to managing the profitability of your book of business while excelling in the marketplace. Gain insights from ecosystem partners and insurers on the importance of data integrations, automation, analytics and no-code tools to increase efficiencies and improve risk selection.

DOWNLOAD WHITEPAPER

Preferred Mutual Insurance Company Adopts Modern Claims System

In less than a year, PMIC implemented Cogitate’s claims system for personal and commercial lines, across all states. Goals achieved include integration with our ecosystem of data and solution providers, automated and streamlined processes, and greater self-sufficiency. Learn more about the benefits of this legacy system replacement now.

DOWNLOAD CASE STUDY

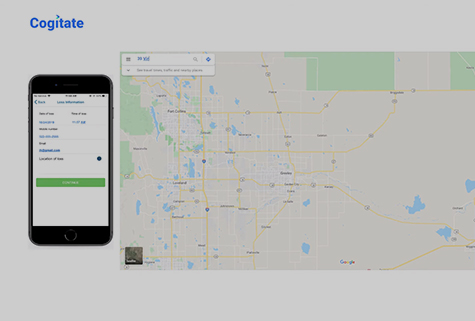

Cogitate Claims First Notice of Loss (FNOL)

Cogitate Claims FNOL is a digital claims reporting tool for the convenience of policyholders. With the help of this solution, insurance carriers, MGAs and wholesale brokers can enable their customers to report the first notice of loss through web portals and mobile apps. It is equipped to handle multiple lines of business and can be quickly integrated with any existing claims management system.

DOWNLOAD DATASHEET

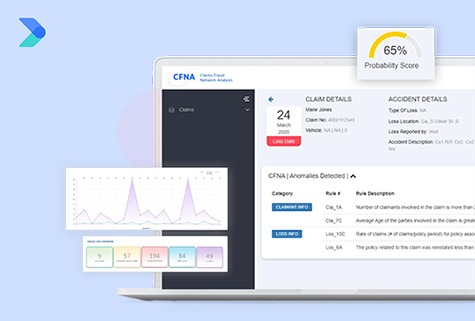

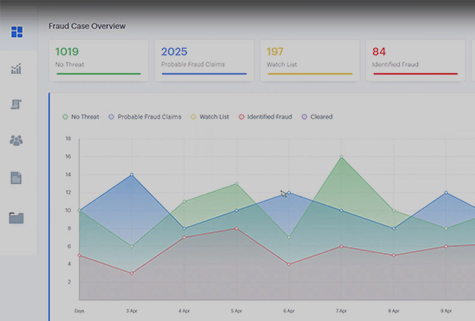

Cogitate Claims Fraud Network Analysis (CFNA)

Cogitate Claims Fraud Network Analysis (CFNA) allows proactive protection to insurance providers against fraudulent claims, using artificial intelligence, machine learning and advanced analytics. It is a futuristic solution that enables insurance carriers, MGAs and wholesale brokers to quickly identify deliberate attempts to submit claims of a fraudulent nature.

DOWNLOAD DATASHEET

Cogitate DemandAssist

Cogitate DemandAssist automates the entire demand letter identification and management process. Demand letters from attorneys are very challenging to monitor and properly address, and can be potentially costly for any insurance company if not properly handled.

DOWNLOAD DATASHEET

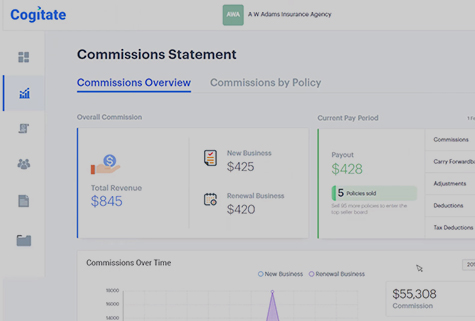

Cogitate Producer Portal

Cogitate Producer Portal is a digital interface that allows insurance carriers or MGAs to enable self-service to their independent or captive agents. The portal provides on-demand access to information related to quotes, policies and business information of an agency.

DOWNLOAD DATASHEET

DigitalEdge Claims

Cogitate's DigitalEdge Claims offers the rich functional depth required to confidently address & manage the entire claims lifecycle, including claim metrics, automated workflows, and legacy migrations across different LOBs. As a result, this solution can meet the evolving demands of your business, customers, and the insurance industry.

DOWNLOAD DATASHEET

DigitalEdge Policy

Cogitate DigitalEdge Policy helps insurance carriers, MGAs, Wholesalers and program managers modernize their business to become more efficient, increase speed to market, and quickly adapt to customers changing needs.

DOWNLOAD DATASHEET

Cogitate Commercial Auto within DigitalEdge Platform

Wholesalers, MGAs, Agents, and Carriers can now use a powerful omni-channel insurance ecosystem to integrate multiple channels, partners, 3rd party data services, and a sleek User Interface (UI) to rate, quote, bind, issue, and post-sale service Commercial Auto within the Cogitate DigitalEdge Platform.

WATCH VIDEO

Southern General Insurance Company Shares the Benefits of Cogitate Fraud Network Analysis to Mitigate Claims Fraud

Watch Ricky Driese, Business Analyst, Southern General Insurance Company, in conversation with Arvind Kaushal, CEO & Co-Founder, Cogitate Technology Solutions, Inc. He explains about CFNA features that allow proactive protection to insurers against fraudulent claims, using artificial intelligence, machine learning and advanced analytics.

WATCH VIDEO

Southern General Insurance Company Shares Savings Realized with Cogitate DemandAssist

Watch Chris Ainsworth, Claims Divisional Leader, SGIC, in conversation with Jacqueline Schaendorf, Director & Co-Founder, Cogitate Technology Solutions, Inc. Chris speaks about how the solution has enabled them to automate identification of attorney demand letters, and helped in monitoring negotiations with attorneys and reducing the risk of bad faith exposures.

WATCH VIDEO

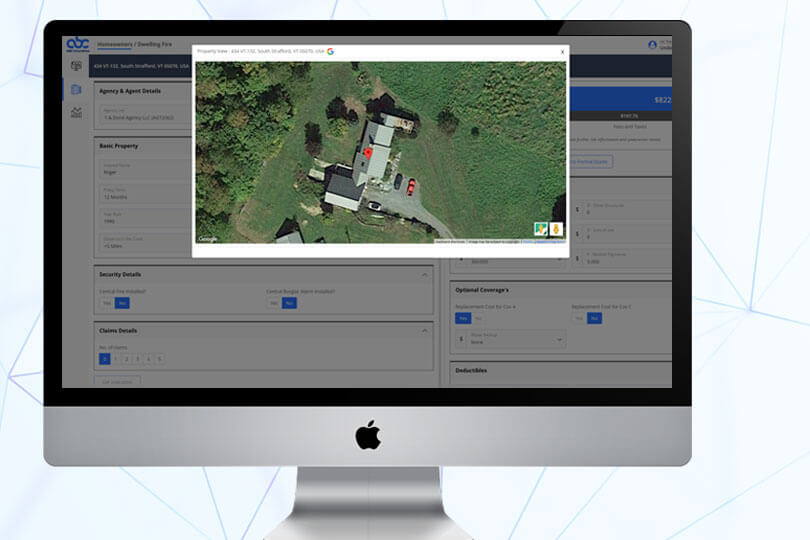

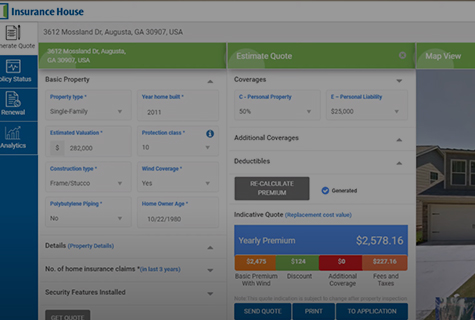

Insurance House Built an Omni-channel Ecosystem with Cogitate DigitalEdge

Watch Elena Leming, VP - Sales & Personal Lines, Insurance House as she speaks about how Cogitate Digital Insurance has helped Insurance House to digitalize their personal property lines business and build an omni-channel ecosystem for their channel partners and customers to connect with them seamlessly.

WATCH VIDEO

Cogitate DigitalEdge Policy in Action: Personal Property Lines

Cogitate Digital Insurance provides carriers, MGAs, wholesalers and program managers with modern ways of conducting business. Learn how you can offer exceptional customer experience coupled with an quick and easy way to manage the entire policy life cycle.

WATCH VIDEO

Cogitate Producer Portal in Action: Agent Self-service

Cogitate Producer Portal is a digital interface with core administration systems, which enables insurance carriers, wholesalers and MGAs to gain operational efficiencies. It offers easy access to relevant information, along with the convenience of self-service to their agents.

WATCH VIDEO

Cogitate Joins SMA-TDI Insights to Solutions Series: Digital Platforms

Watch Arvind Kaushal, CEO & Co-Founder and Jacqueline Schaendorf, Director & Co-Founder Cogitate speak at “The Insights to Solutions Series: Digital Platforms”, organized by SMA and TDI. They demonstrate the capabilities of Cogitate DigitalEdge Insurance Platform and how it helps insurance companies to ReImagine, ReAlign and Transform insurance.

WATCH VIDEO

Watch Cogitate Intelligent Claims for Insurance in Action

Cogitate Intelligent Claims solutions for insurance include a bouquet of modern technology products that streamline claims processing to reduce processing costs and time, and helping in the early detection of possible fraud to mitigate the risk of potential losses and litigations.

WATCH VIDEO

Watch Cogitate DemandAssist in Action

Cogitate Demand Management is a unique solution that enables carriers, wholesalers and MGAs to automate identification of attorney demand letters, and helps in tracking progress throughout their life cycle. This solution also helps in monitoring negotiations with attorneys and reducing the risk of bad faith exposures.

WATCH VIDEO

Watch Cogitate Claims Fraud Network Analysis in Action

Cogitate Claims Fraud Network Analysis (CFNA) is a futuristic solution that allows proactive protection to carriers, MGAs and wholesalers against fraudulent claims, using artificial intelligence, machine learning and advanced analytics.

WATCH VIDEO

Watch Mobile & Web-enabled Cogitate Claims First Notice of Loss in Action

Cogitate Claims FNOL is a digital claims reporting tool for the convenience of policyholders, agents and insurance companies. The solution uses web portals & mobile apps to simplify the claims reporting process for customers and delivers an efficient, effective and satisfying customer experience.

WATCH VIDEOLooks like something is wrong. Kindly verify your email address.

TRY AGAIN!