09

Jan

Unleashing the Power of Intelligent Underwriting

In the ever-evolving insurance landscape, staying ahead of the curve is not just an advantage—it’s a necessity. Our latest whitepaper, 3+ Keys to Proactive Underwriting delves into the transformative realm of intelligent underwriting and how it can revolutionize user experience from submission through bind and servicing. Property and casualty insurers and DUAEs can improve customer selection, reduce cycle times, and meet goals for profitable growth by implementing automated underwriting capabilities enhanced by trusted third-party data integrations. Integrating third-party data sources is pivotal in identifying misinformation and nondisclosures and validating underwriting decisions. Real-time data and API-enabled platforms further elevate the underwriting process by accelerating submission and underwriting cycles. These cloud-native, microservices architected platforms enable seamless integration with data partners, ensuring that property and casualty insurers and DUAEs are equipped to make well-informed decisions today and into the future.

The whitepaper underscores how the current inflationary conditions have further heightened the historic problem of underinsurance within the personal and commercial property lines and how intelligent underwriting can be the solution. As building costs rise, without access to real-time property intelligence, replacement value calculations may underestimate the realities of a specific region – cost of materials, labor, impact of new building codes, and more.

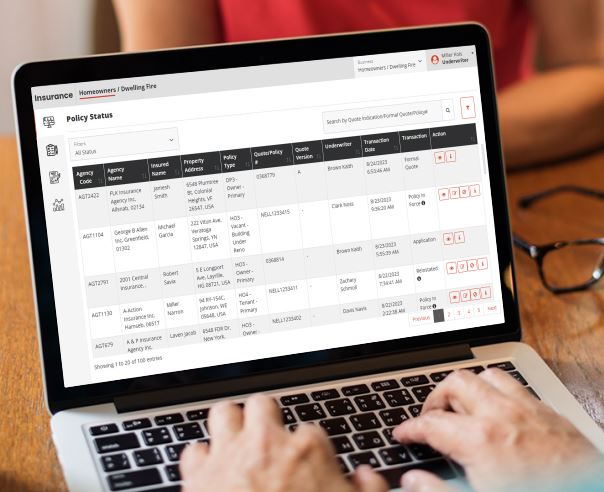

Our DigitalEdge Insurance platform, integrated with property intelligence, equips underwriters with accurate real-time data and bridges the gap between coverage and risk, ensuring that policies are properly priced and policyholders are adequately protected in the event of a claim.

Another example where data validation and data prefills can streamline submissions and underwriting is seen in the personal auto lines. With proper vehicle and driver verification, undisclosed material information is discovered at submission. (For the results of Southern General Insurance Company’s undisclosed driver study, read Claims Intelligence, Predictive Modeling, & Data Validation)

Our DigitalEdge Insurance platform, with its ever-growing ecosystem of partners, is designed to meet the dynamic needs of insurance businesses, enhancing operational performance and ushering in a new era of efficiency.

The insurance landscape is evolving, and so must our approach to Underwriting. 3+ Keys to Proactive Underwriting is not just a whitepaper; it’s a blueprint for the future of insurance. Intelligent Underwriting, backed by advanced data intelligence, is the key to unlocking new possibilities and staying ahead in an industry that demands innovation.

Related Content: Claims Intelligence, Predictive Modeling, & Data Validation

Looks like something is wrong. Kindly verify your email address.

TRY AGAIN!