Cogitate

DigitalEdge Policy

Faster, Simpler, Better Policy Management

Digital Edge in Insurance

Cogitate DigitalEdge Policy helps insurance carriers, MGAs, wholesalers and program managers modernize their business to become more competent, increase speed to market and quickly adapt to the changing needs of customers. It accelerates digitalization of insurance by integrating with core and legacy systems, and brings the benefits of third-party data integrations.

DigitalEdge Policy transforms channel partner and customer experience by offering an array of insurance technologies, from digital sales and service infrastructure, integrated mobile apps and chatbots to artificial intelligence, machine learning and advanced analytics.

“Several of our friends in the business use the Cogitate solution. They highly recommended Cogitate for their industry expertise, solution capabilities and their friendly team who work with the customer to solve their issues. Our new claims system engages users throughout the claim lifecycle. It is helping our team to reinvigorate claims processes to improve customer experience, increase efficiency, and reduce operational cost. It is pre-integrated with various third-party data services and also with our other internal systems for real-time exchange of information.

Traders Insurance

“Partnering with Cogitate is another step toward our long-term goal of digital transformation. We are pleased to work with a technology vendor that truly understands the needs of the modern independent MGA. As the insurance distribution landscape changes, so do the needs of our agents. We are committed to putting our agents first; adopting software which increases the value that we add to our role in the industry, speeds turnaround time and enhances the customer experience.”

New England Excess Exchange

“We are very excited about working with Cogitate. Their innovative digital platform will further strengthen our ability to offer an unmatched channel partner and end-user customer experience. Also, this technology offers straight-through processing with built-in workflows for Underwriter approvals which will make it easy for our channel partners and customers to do business with us.”

RPS

“Cogitate Digital Insurance has helped us to digitalize our personal property lines business and build an omni-channel ecosystem for our channel partners to connect with us seamlessly. We currently are writing policies for Homeowners and Mobile Home insurance through this platform. It is integrated with our existing systems including AIM and ImageRight. This allows our agents and underwriters to easily access the required information whenever they need. It is full of brilliant features such as ‘Quote in a Minute’, Customer E-signature verification, Post-sale Services workflow and built-in Property Analytics tools. Personal Property insurance platform has quickly become one of the pillars of our digital business initiatives.”

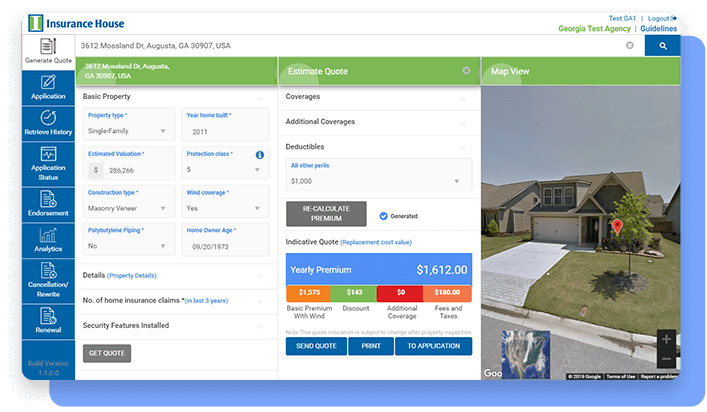

Insurance House

Watch DigitalEdge Policy in action

WATCH VIDEODigitalize End-to-end Policy Lifecycle for

All Personal, Commercial, and Professional Lines

Simplify and automate to reduce operational inefficiencies and make your policy management lifecycle faster with Cogitate DigitalEdge Policy. This delivers exceptional customer experiences to your users - both customers and channel partners - across the insurance value chain.

Cogitate Rater

Rating a risk is a core element of the insurance business. Cogitate Rater is a sophisticated tool that provides a real-time rate response for any line of business. It can be used by insurance companies of all sizes to create new products which can be quickly distributed through channel partners and online insurance distribution platforms.

Cogitate Quote, Bind and Issuance

Cogitate Quote in a Minute feature the proprietary Adaptive API technology that allows easy integration with multiple third-party services to pull relevant risk information to prefill forms and obtain a quote. The Quote module is already integrated with Cogitate Rater. The Cogitate Bind and Issuance module is seamlessly integrated with Cogitate Quote to populate the application with risk information captured and calculate an actual premium.

Cogitate Post-sale Services

Cogitate Post-sale Services digitalize the workflows of policy services and help in the lifecycle management of a policy, including service requests like endorsements, renewals, cancellations, rewrites and reinstatements.

Next-Generation Technology for Insurance

Low Code No Code

Cogitate DigitalEdge Policy is powered by Low Code No Code capability to bring speed to market. It provides an easy-to-use interface for business users to configure products without writing code or any help from the IT team. They can build and modify rates, forms, underwriting rules, workflows, add new states and more from useful templates. The Low Code No Code helps reduce development and launch time by as much as 10 times than traditional linear and sequential approaches.

Analytics

The built-in analytics capability within the Cogitate DigitalEdge Policy helps you to make better-informed decisions by making sense of your existing risk and customer data. Analytic tools built for insurance provide deeper insights and actionable intelligence about your business.

Intelligent Underwriting

Powered by data-driven and digital automation technologies Cogitate DigitalEdge Policy brings in efficiencies to transform the traditional underwriting process. It minimizes manual user inputs and aids underwriters with more accurate assessments of the risks.

-

Low Code No Code

Cogitate DigitalEdge Policy is powered by Low Code No Code capability to bring speed to market. It provides an easy-to-use interface for business users to configure products without writing code or any help from the IT team. They can build and modify rates, forms, underwriting rules, workflows, add new states and more from useful templates. The Low Code No Code helps reduce development and launch time by as much as 10 times than traditional linear and sequential approaches.

-

Analytics

The built-in analytics capability within the Cogitate DigitalEdge Policy helps you to make better-informed decisions by making sense of your existing risk and customer data. Analytic tools built for insurance provide deeper insights and actionable intelligence about your business.

-

Intelligent Underwriting

Powered by data-driven and digital automation technologies Cogitate DigitalEdge Policy brings in efficiencies to transform the traditional underwriting process. It minimizes manual user inputs and aids underwriters with more accurate assessments of the risks.

Be Future-ready with

Cloud-native

The SaaS model of the cloud-native Cogitate DigitalEdge platform helps insurance companies of all sizes to rapidly scale up, build and launch new products faster and drive efficiencies across the insurance value chain - from marketing and sales to underwriting and claims. DigitalEdge is always upgraded with the latest updates and state-of-the-art technology to improve business efficiencies, bring cost benefits, and attain competitive advantages. The basic one-time implementation cost with a 'Pay-as-You-Grow' subscription model results in a significantly lower total cost of ownership (TCO).

Scalable and Modular

The ability to scale up or down as per the business need coupled with the modularity of the platform provides much-needed flexibility and agility. The Cogitate DigitalEdge Policy is scalable and syncs with the growth of your organization - new lines of business, geographical expansion, additional programs and more. The modular nature of the solution makes it easy for insurance companies to choose feature-wise modules as per their specific requirements.

Adaptive APIs

The proprietary Adaptive API technology of the Cogitate DigitalEdge Platform enables an easy, agile and efficient way to integrate with virtually any system and/or IOT device including your existing core and legacy systems, raters of multiple carriers, third-party services and data sources. All this and more without spending a lot of time and money.

Benefits

Accelerate Digitalization

Achieve omnichannel (B2B and B2C) distribution by easy integration with existing Core & Legacy Systems

Rapid Implementation

Go Live in 8-12 weeks

Transforming User Experience

Deliver meaningful and relevant experience across the policy life cycle to build brand loyalty

Increased Speed to Market

Launch new products for your customers quickly and get an edge over the competition with Low Code No Code capabilities

Reduce Operational

Cost

Enhance the efficiency and productivity with no hidden charges and fees, and 'Pay-as-You-Grow' model

Future-ready, Cloud-native Platform

Flexible, scalable, modular and replicable to support future growth

Faster Communication

Offers seamless communication across the insurance value chain participants

Line of Business Agnostic

With customizable and configurable modules digitalize any line of business

Manage the Entire Policy Lifecycle

Across All Lines of Business

Pre-integrated Partner Ecosystem

with Cogitate DigitalEdge

The power of a robust information ecosystem with several third-party data partners makes Cogitate DigitalEdge a comprehensive solution for personal, commercial and professional lines. These partner databases come pre-integrated with DigitalEdge and not only lead to a faster processing time but also better and more accurate risk evaluation. Cogitate's proprietary Adaptive API technology facilitates effortless and quick integration with any data sources allowing a consistent expansion of the partner ecosystem and bringing richer risk information to insurers.

Interested in learning more about our DigitalEdge Policy?

DOWNLOAD DATASHEETLooks like something is wrong. Kindly verify your email address.

TRY AGAIN!